Taxes on vehicles imported to Sri Lanka range from 250% to 350% (Feb. 2008), what are the impacts of this on the environment, the population & the economy ?

I warn you that the following would be a vague attempt to understand the overall impact caused by higher taxes.

The government states that taxes are intended to reduce oil consumption thereby reducing the oil bill which stand for more than 50 % of overall imports, this would also discourage buyers also saving foreign exchange and the list would go on. Firstly let us consider the vital factor of oil consumption.

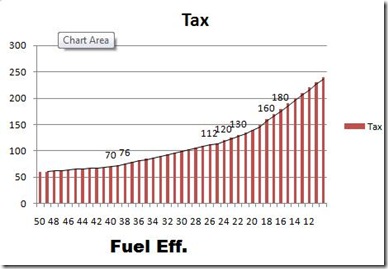

According to specifications a 2001 Honda civic would do 35 mpg in comparison to 45 mpg of a 2008 Honda civic Hybrid (data from edmunds.com). That is almost 10 miles to the gallon more than its earlier cousin. A used 2001 Honda Civil in Sri Lanka approximately costs the same as a brand new 2008 Honda Civic Hybrid.

Average Sri Lankan motorist uses 0.93 (1) litres of "oil" every day, therefore on a 2008 model the motorist would achieve an increase of efficiency of 30 % thereby being able to get by with .651 litres.

An increase of 30 % efficiency would mean that the consumption of 2610000 litres would be reduced to 18270000 litres a saving of 6750 barrels which turns out to be a saving of 81000 $ (2) a day.

Obviously the above calculation has many flaws, to begin with an increase of 30 % fuel efficiency might not be true in all cases (it could be more, it could be less) and the calculation assumes that number of vehicles on the road would remain the same in other words the more efficient vehicles would replace the inefficient which is also incorrect.

An article mentions that 50000 vehicles are unroadworthy in Colombo alone, the same article mentions that 1500 vehicles a month are issued prohibition notices. Therefore if you consider that these unroadworthy vehicles are in fact replaced with the more efficient models (as they should be), within a year 68000 vehicles would be gaining the 30 % increase in efficiency. again this would be translated to a saving of 80184 $ or roughly 8.7 million rupees a day.

People would not simply discard their vehicles to obtain newer vehicles, but it is not the 2001 model which in fact needs to be replaced, it is the bottom of the pyramid, the gas guzzling cars from the early 80's or even the 70's. If the government does reduce the taxes on brand new cars the 2nd hand market in Sri Lanka would be affected, drastically reducing the prices of vehicles. This would mean more people would have an incentive to buy brand new or a used car in a good condition for a lower price, this would also mean that it is not worth to sell a really old car as the price he/she would receive for it would be trivial and not worth the trouble. Therefore with a reduction of taxes the cycle would work as such that the older would by default get replaced.

Now with the taxes reduced there is an incentive for non vehicle owners to purchase a vehicle, therefore the number of purchases would indeed increase. Still considering that 6800o vehicles are discarded and the oil consumption is left constant at the current consumption at 2610000, considering the average consumption of .651 litres of "oil" per day, it can be deducted that 88400 vehicles could be on the road for the 68000 discarded. Obviously there are schemes to control the ownership of vehicles to ensure that one motorist would not own excessive vehicles and to ensure that consumers do purchase fuel efficient vehicles (reports suggest that the government scheme for officials to purchase duty free vehicles resulted in many purchasing a particularly fuel inefficient Mitsubishi SUV) such issues would be discussed in a future post.

Properly implemented tax cuts would improve the living conditions of 20400 people in the first year. Furthermore this would effect positively on the national economy in various forms providing enhanced connectivity between cities etc. It also has other costs for the state such as infrastructure development costs etc. There are indeed other aspects to this, which would be discussed in the upcoming postings such as the impact of lost revenue to the economy, the environment impacts etc.

Finally where the average motorist is concerned, he/she could improve the standard of living by reducing the fuel bill by 30 %, an average Sri Lankan would be able to purchase a vehicle thereby again increasing the standard of living. It brings to mind the question on the validity of the government statement that the taxes would only affect the "rich", as it can be deducted that the average Sri Lankan is losing an option to enhance his/her living standard so that the ministers and other corrupt officials of the country can enjoy duty free access to vehicles.

The following calculation is based on data collected from different sources therefore may provide inconsistent results.

(1)

90000 (barrels of oil imported per day) * 116 = 10440000 litres

35 % used on transportation = 2610000 litres

280000 million vehicles registered

Therefore - 2610000/2800000 = .93

(2)

2610000 * (70/100) = 1827000

6750 * 120 = 81000